SCR Calculator for Insurance Investors

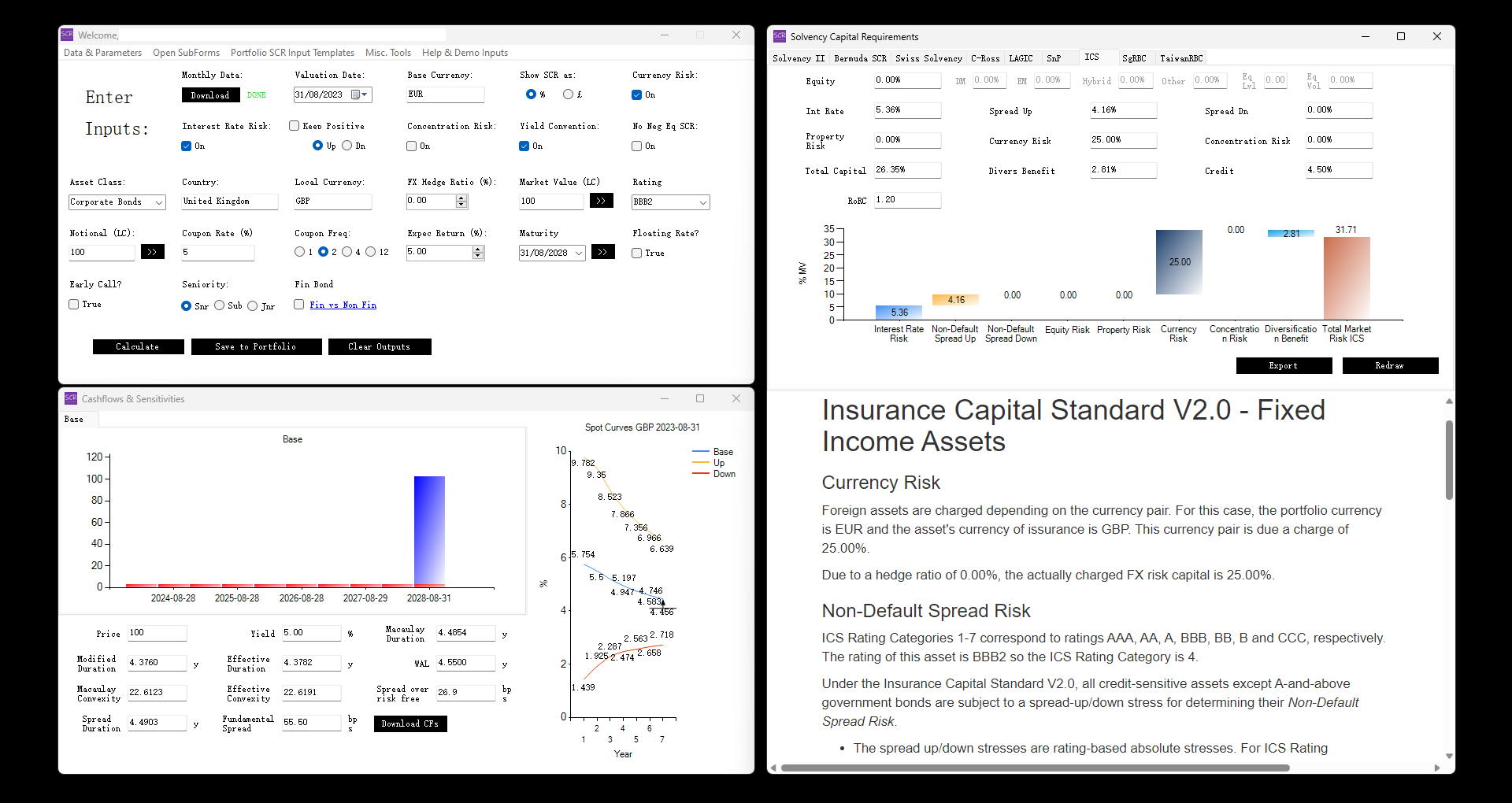

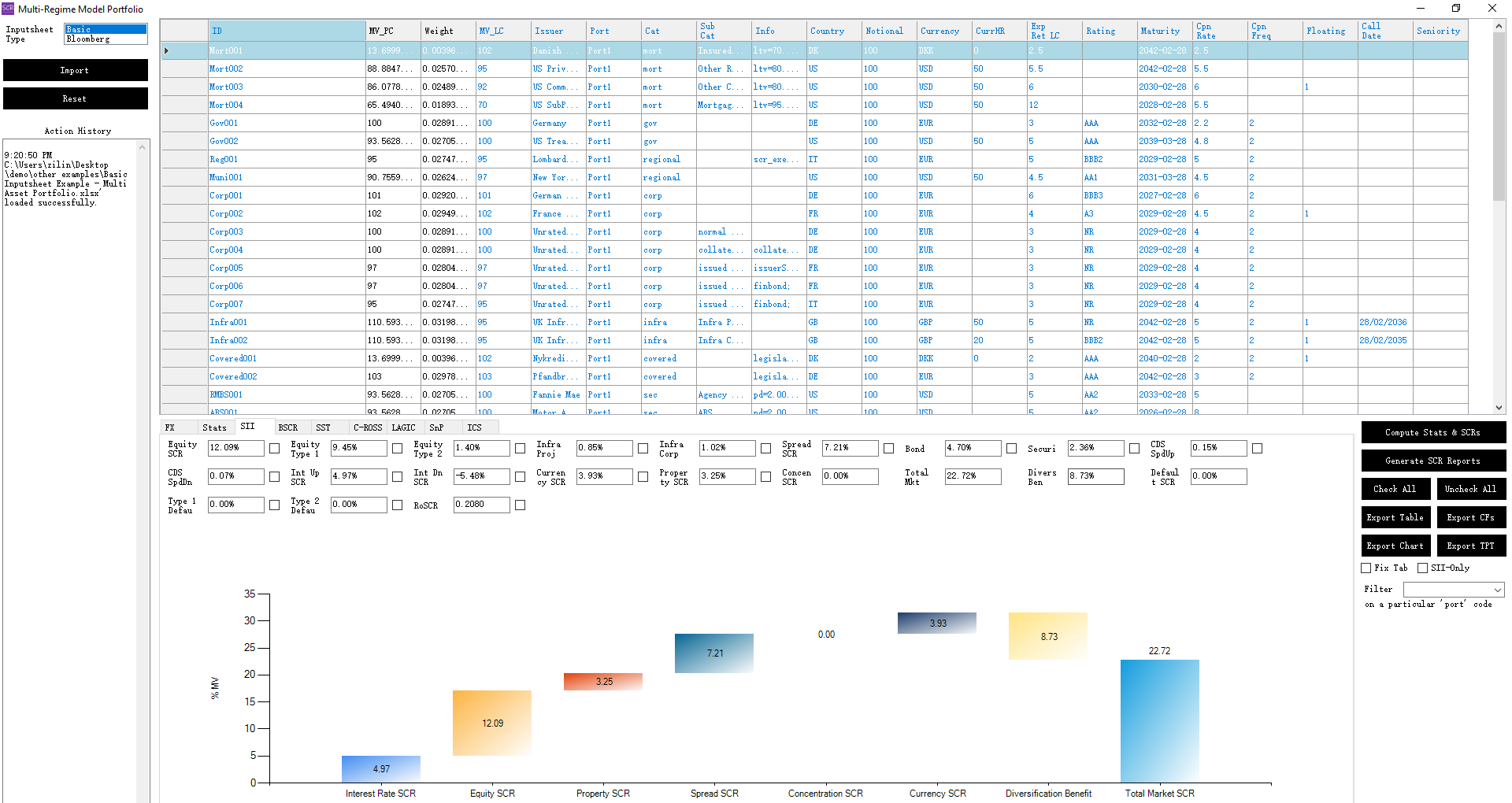

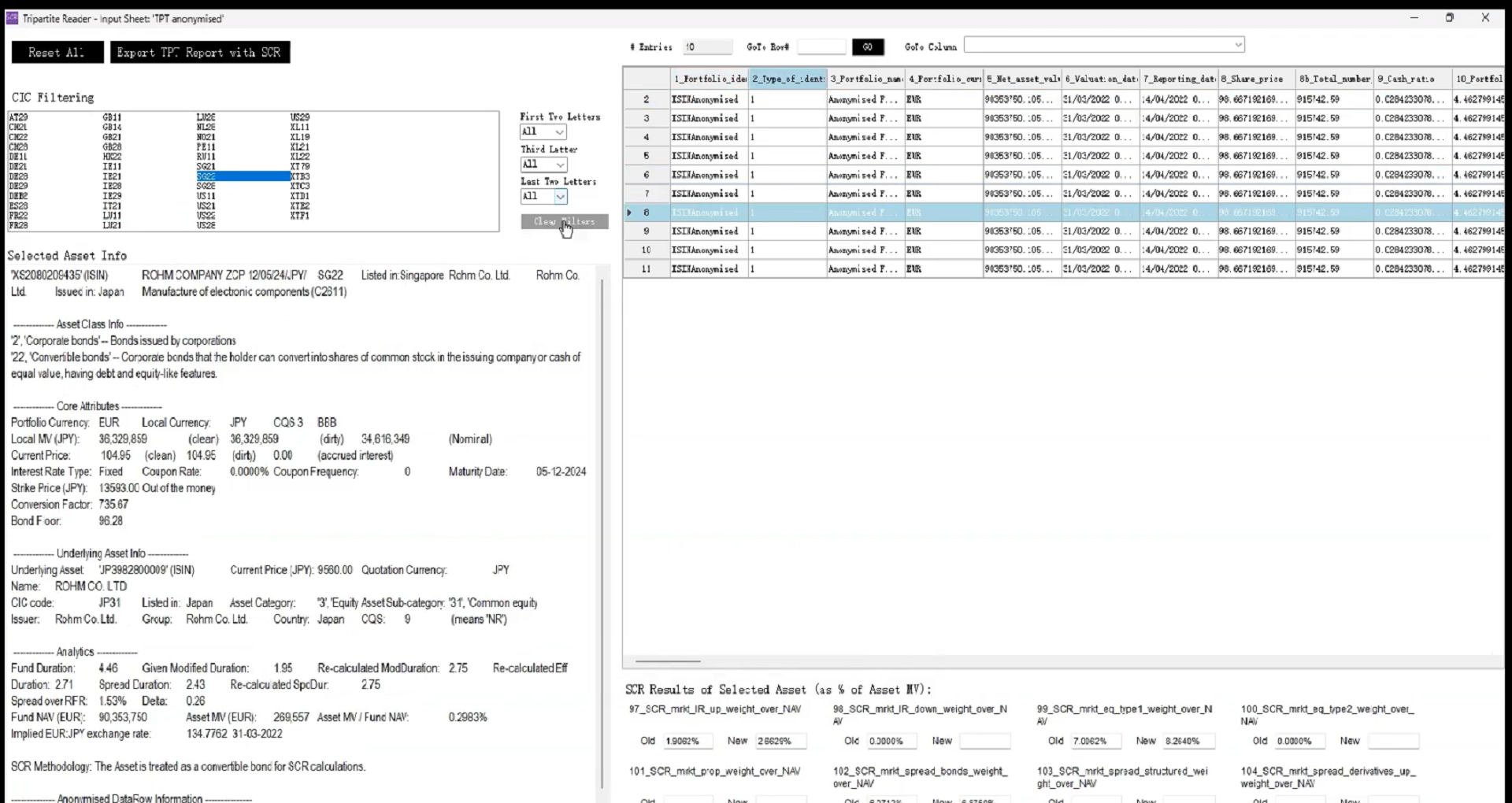

The SCR Calculator is a C# .NET desktop application designed to calculate multi-jurisdictional Solvency Capital Requirements (SCR) for investment assets. By streamlining complex calculations, it supports the daily work of insurance-focused strategy, sales, and portfolio management teams

Data Confidentiality

All calculations run locally on your computer, ensuring strict confidentiality with no data transfers.

Multi-Jurisdictional

Covers Solvency II, Swiss, Bermuda, C-Ross, LAGIC, S&P, ICS v2.0, and other key regulatory frameworks.

Verbal Explanations

Explains calculations clearly in English, with key figures shown to support audits and replication.

Office Automation

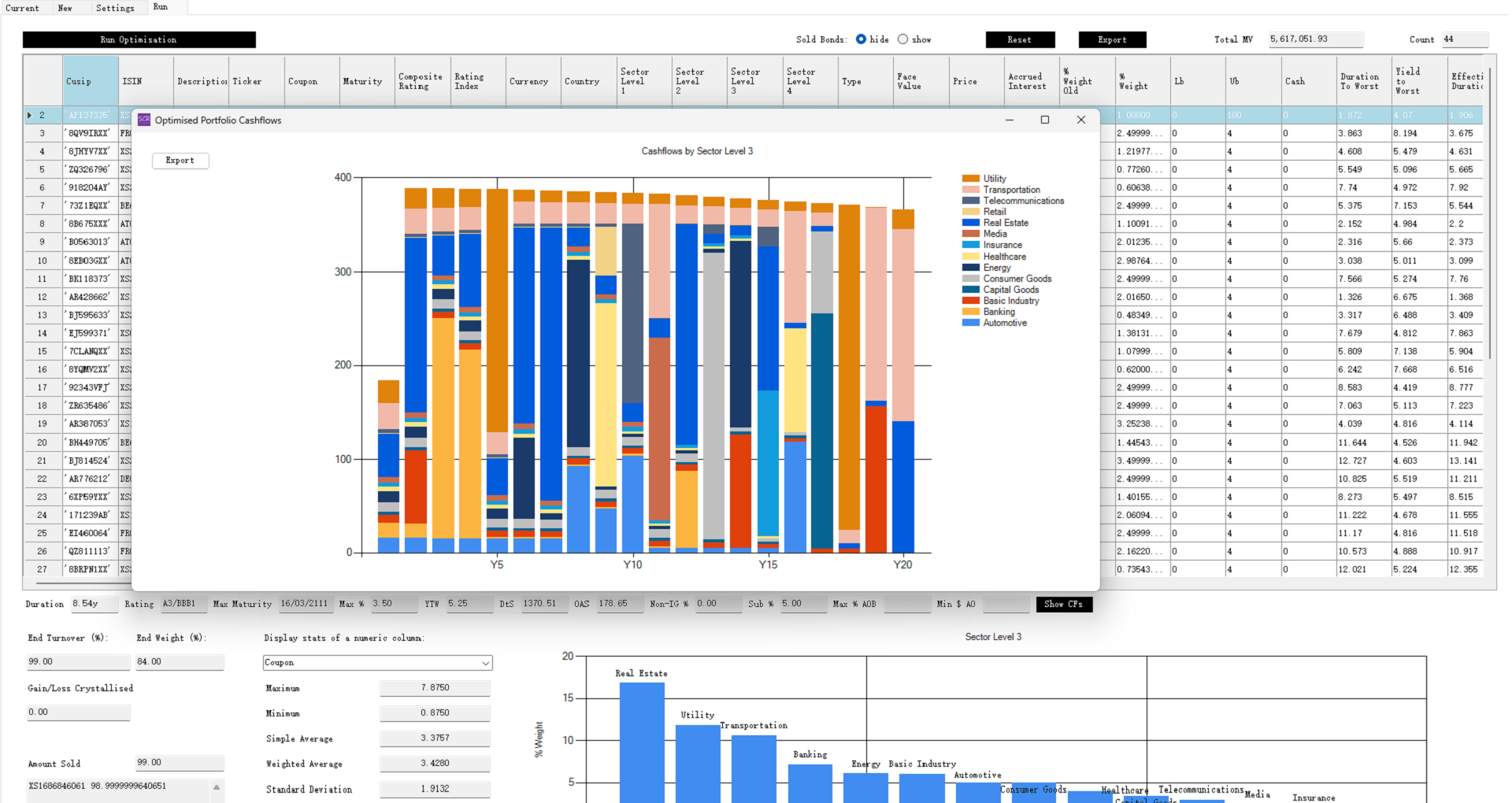

Exports calculated data and auto-generates Excel reports and PowerPoint charts in one click.

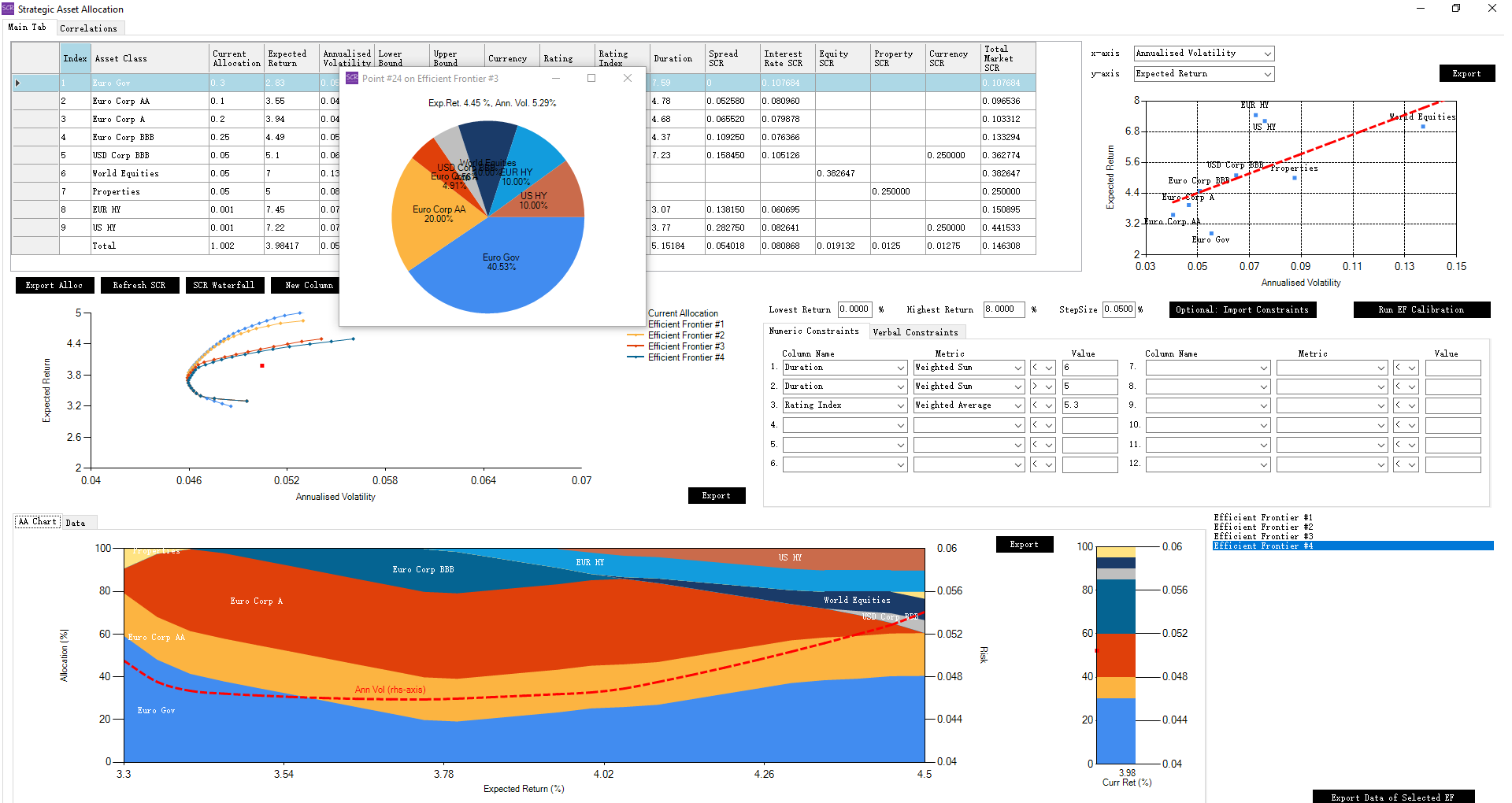

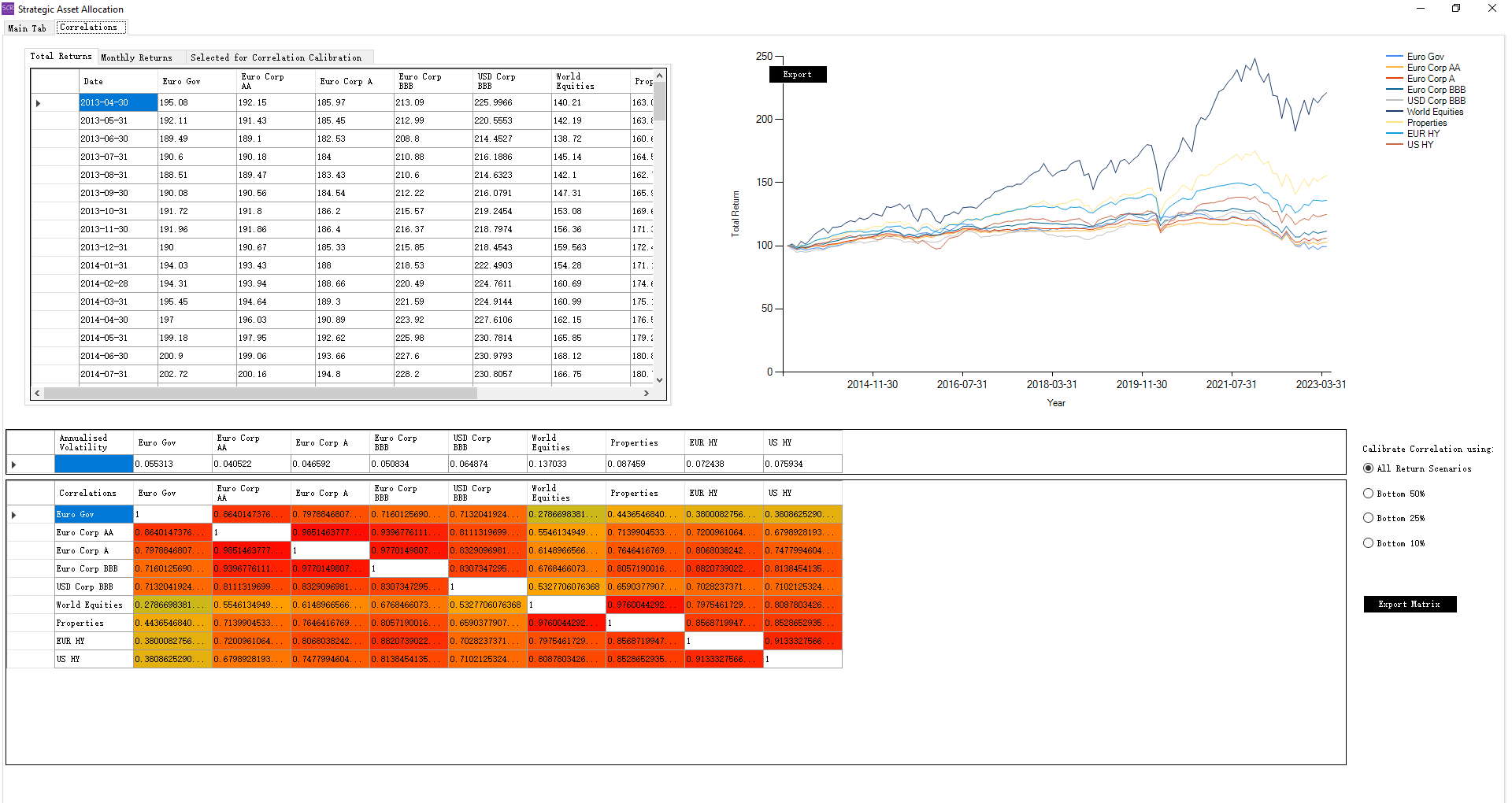

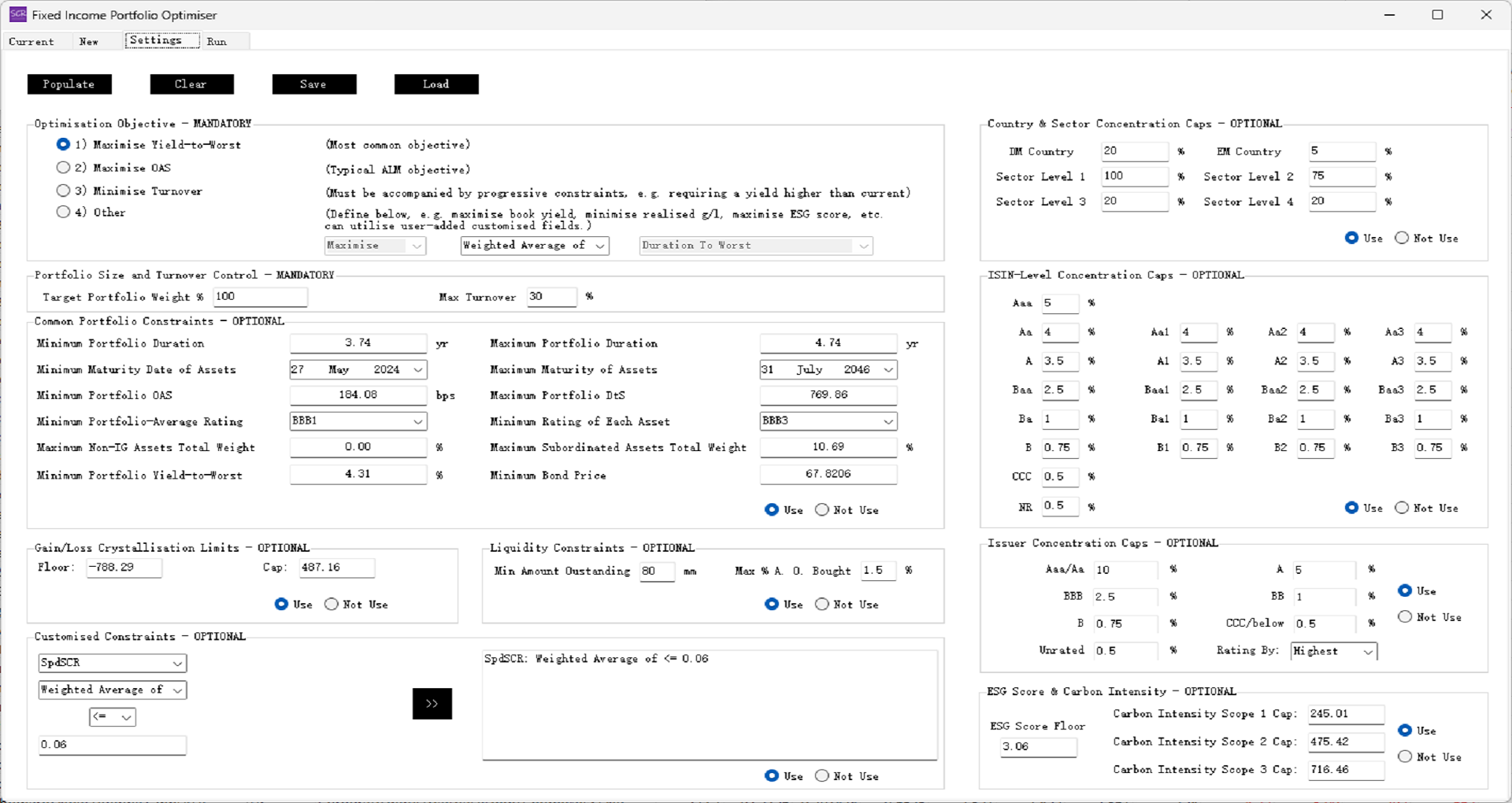

SAA Optimiser

Optimises strategic asset allocation with constraints, surplus targeting, and an intuitive interface.

Portfolio Optimiser

Refines portfolios with turnover control, boosting P&L through precise, targeted adjustments.

Latest Version

The latest version is 1.17.3.0. Note that this app only accepts work SSO accounts.

Installation and Upgrade

You can choose between a MSIX installer or a MSI installer or a an EXE installer. All are x64-only.

What's New?

[2025-4-4] Improvements to Interest Rate Risk Capital Calculations; Added Amortised Bonds