SCR Calculator User Manual

Version 1.17 Last modified 2025-4-6

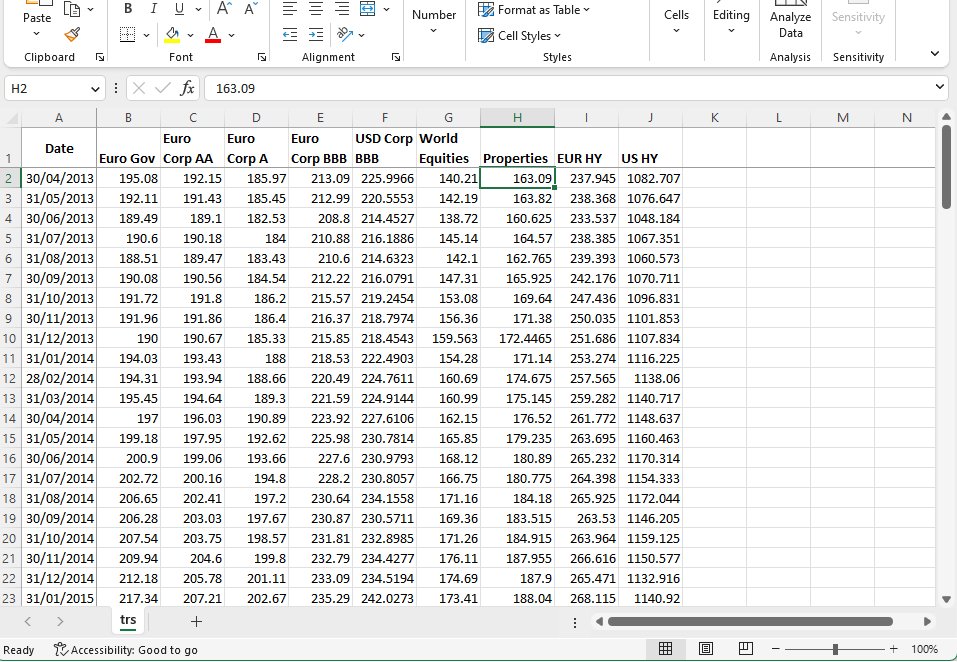

Step 2: Import Total Return Series

Next, prepare and import a second spreadsheet (or tab) containing the monthly "Total Return Series" (TRS) for your assets, as shown below (example available for download):

Ensure the assets in the TRS spreadsheet align with those in the allocation table. The naming can differ, and names in the TRS file will override those in the allocation table.

Use the "Import TRS" button to upload this data. During import, the form briefly switches to the "Correlations" tab before returning to the main tab.

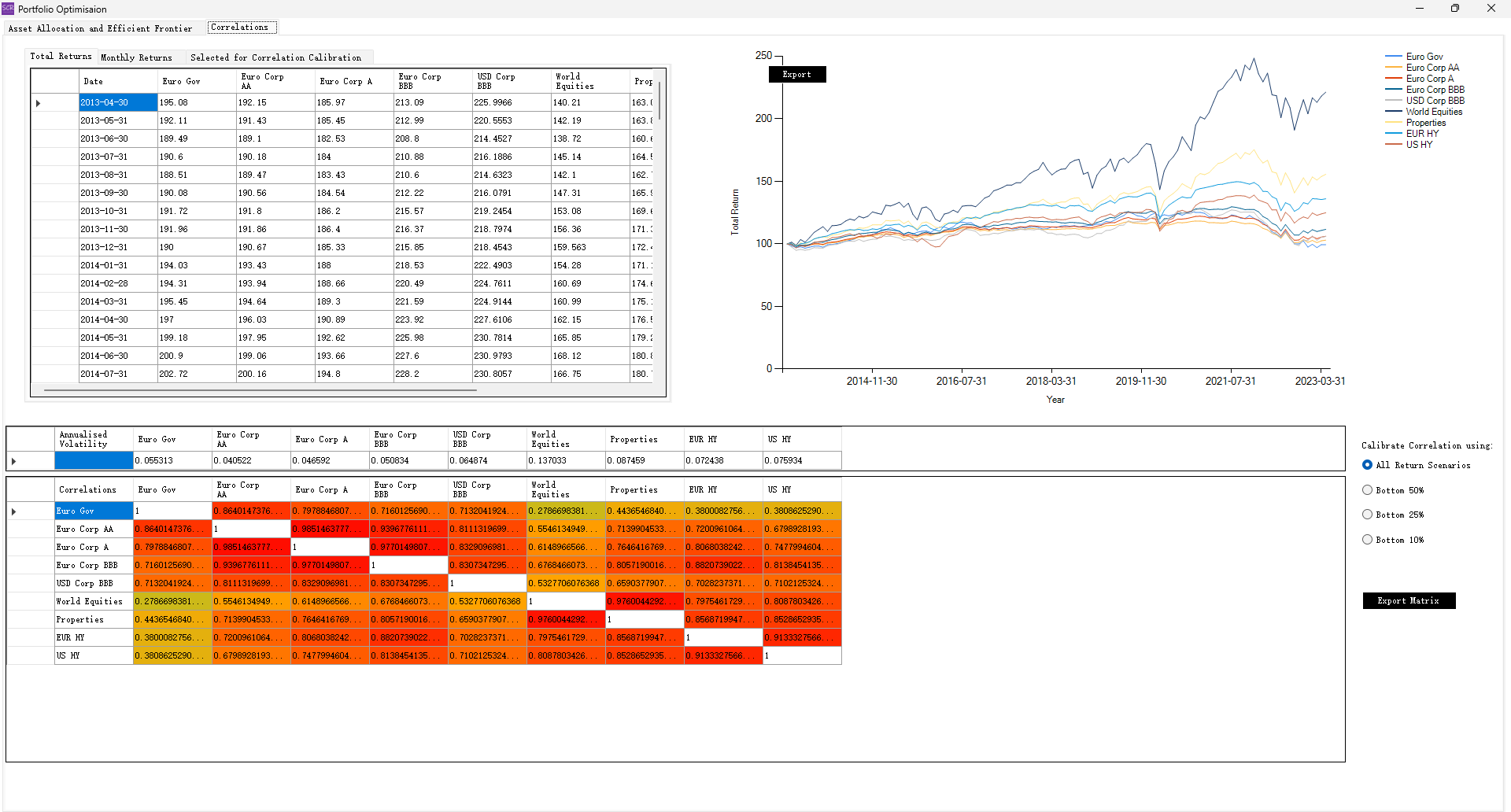

Optionally, you can review the "Correlations" tab to see what has been calculated:

- Total Return Series chart, rebased to 100 on day 1.

- Annualised Volatilities table.

- Correlation Matrix table.

You can adjust calibration to focus on the Bottom 50%, 25%, or 10%, depending on your preferences.

The calibrated correlations are a critical input for generating the efficient frontier.

Back on the main tab, you will notice that the "Annualised Volatilities" column is now fully populated.

Pre-existing figures in this column are not overwritten, and empty cells are updated with values from the TRS calibration.

The same applies to the "Expected Return" column. You can edit these columns at any time to ensure the values align with your expectations.

Next, click the "One-click SCR" button (details explained in the next chapter).

This will add Market Risk SCR columns to the allocation table.

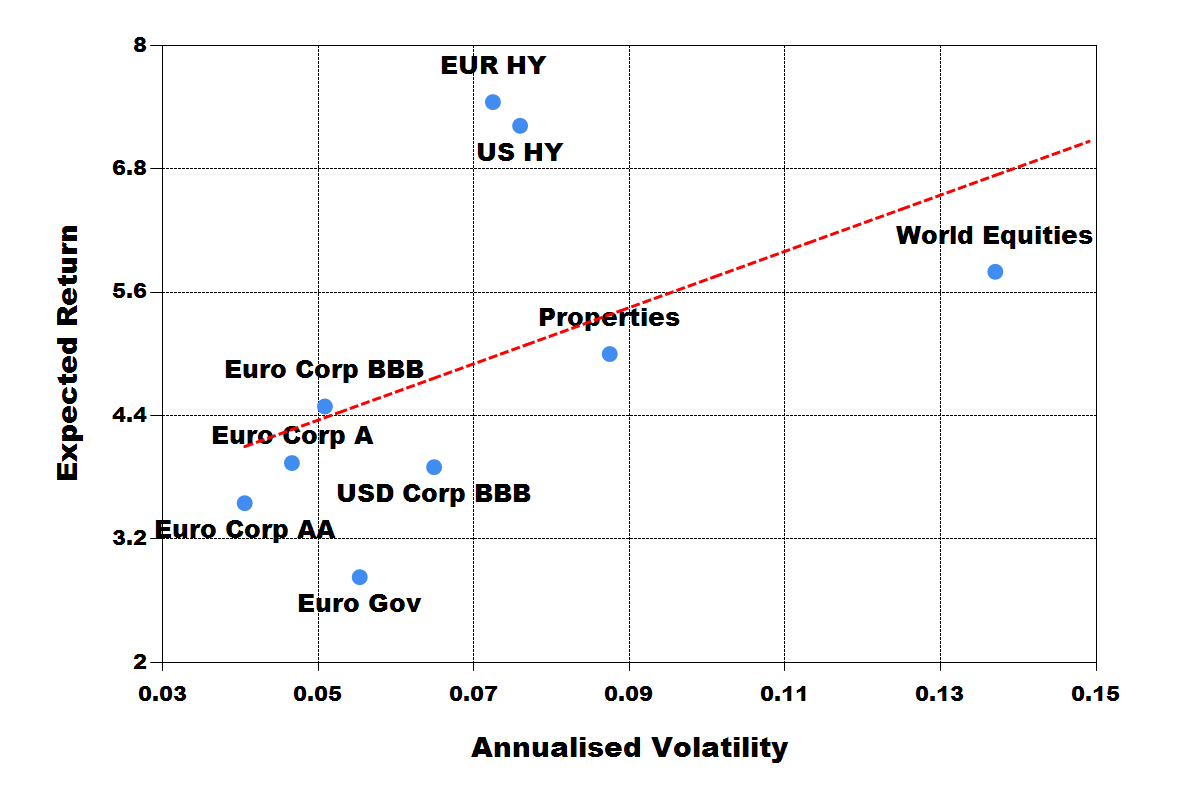

The scatter plot in the top-right corner will now display content. You can:

- Switch between different axis combinations.

- Resize the plot by dragging its edges.

- Export the plot as a PowerPoint slide or PNG image.

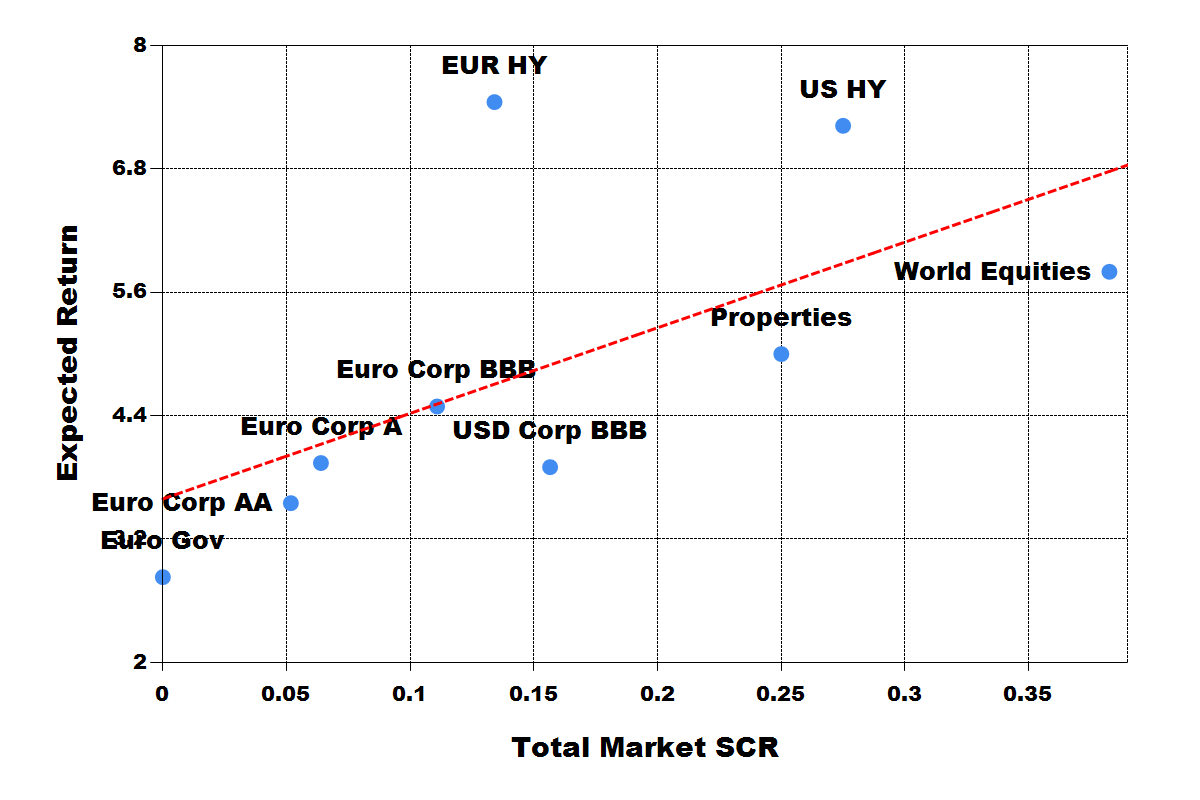

Below are two exported plots: Risk-Return and SCR-Return. In this example, EUR HY appears to outperform US HY in both risk-adjusted return and Return-on-SCR.

In the second chart, the "Int Rate Risk" and "Currency Risk" checkboxes in the Settings were unchecked,

excluding them from the Total Market SCR, though they are still displayed in the allocation table as columns.