SCR Calculator User Manual

Version 1.17 Last modified 2025-4-6

Convertible Bonds

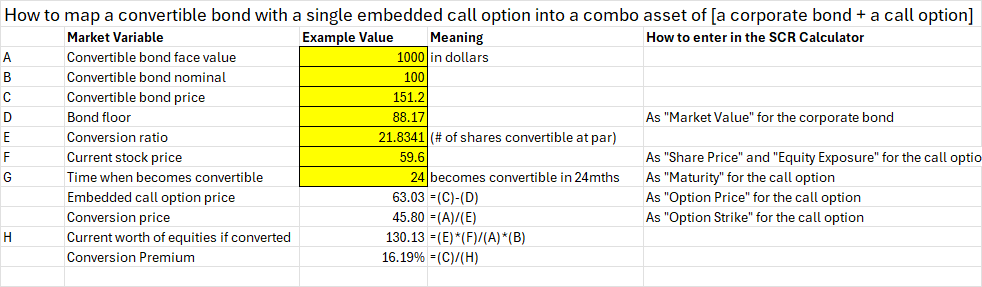

Convertible Bonds can be modeled as a "Combo Asset" consisting of two components: a corporate bond (often floating rate and high quality) and an equity call option. In the SCR Calculator, assign a common "Combo ID" to these two assets and ensure accurate quantities are entered. See the table below for an example convertible bond:

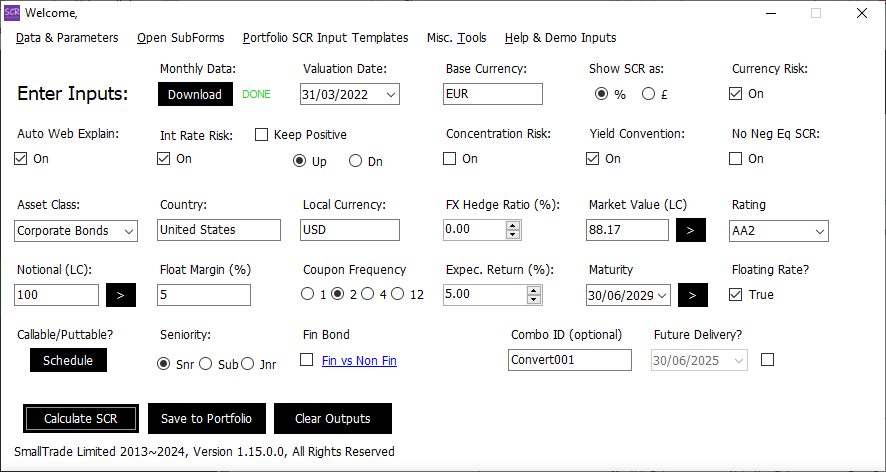

Inputs for the corporate bond in the SCR Calculator:

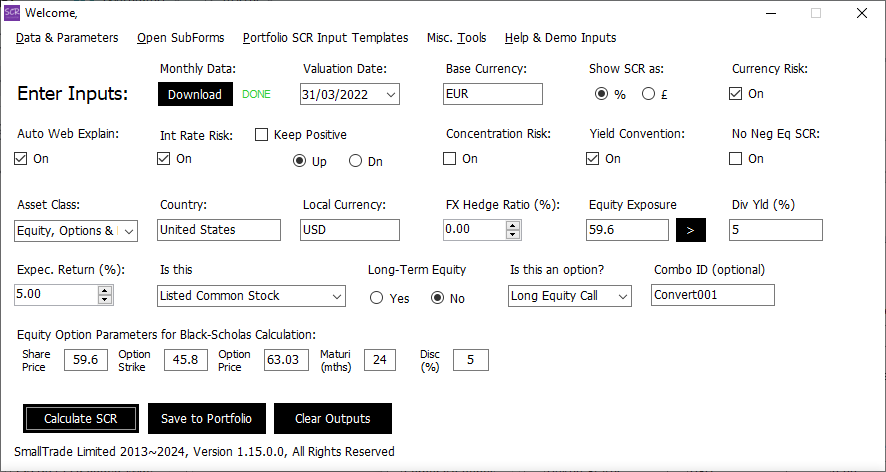

Inputs for the call option in the SCR Calculator:

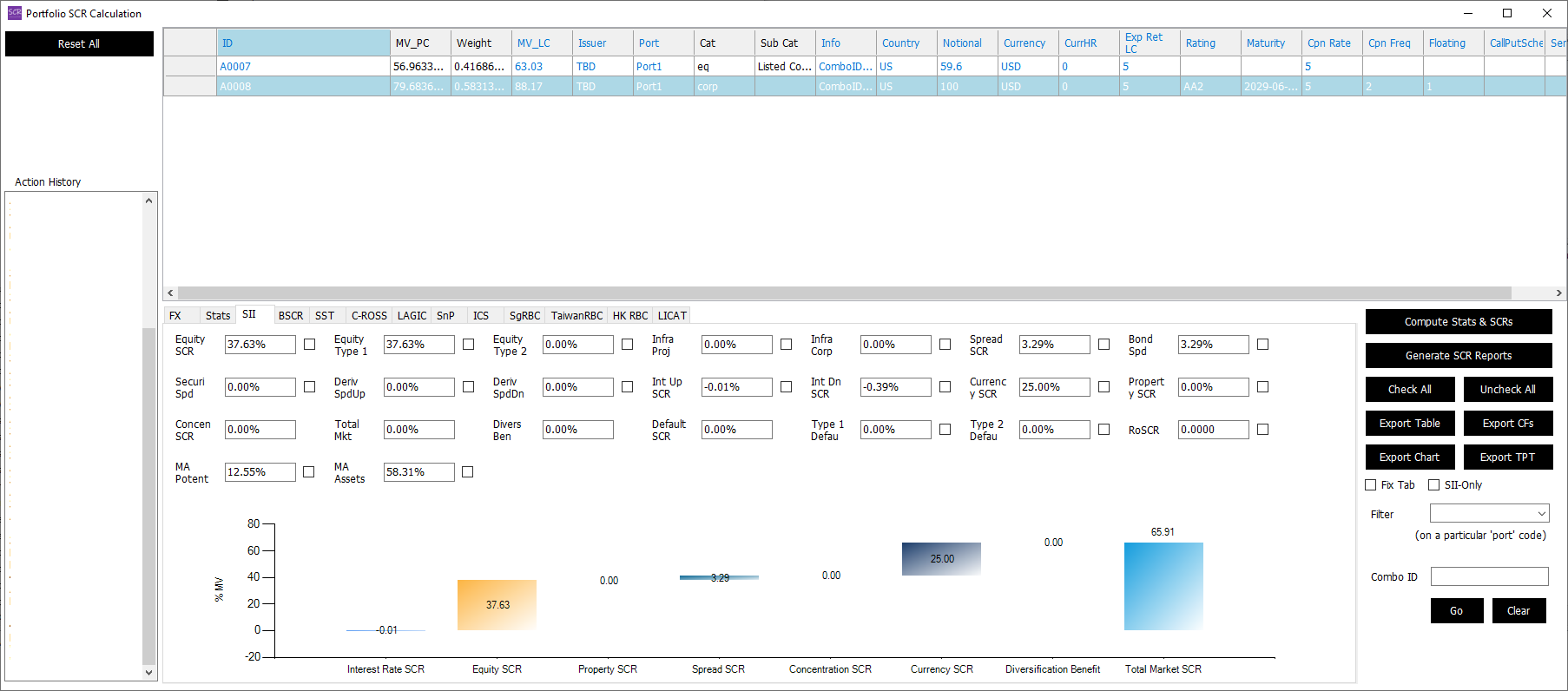

When both components are added to a portfolio with the same Combo ID, the SCR is calculated at the portfolio level, accurately representing the convertible bond's SCR:

When exporting the portfolio, the 'ComboID=xxx;' is automatically added to the 'Info' column of the input sheet. Alternatively, you can manually add this information directly in the portfolio form or by editing the input sheet.

If the convertible bond allows multiple conversion dates, each can be entered as a separate call option to obtain an accurate SCR estimate for the bond.

For large portfolios, the "Combo ID filter" in the lower-right corner allows you to isolate specific combo assets and analyze their standalone SCR.

For standard assets, leave the "Combo ID" field empty.

Example files: